Chit fund Company

A chit fund is a very popular type of savings scheme in India – in fact, it is one of the main parts of the unorganized money market industry. The chit fund company, which runs a chit fund, provides access to savings and borrowings for people with limited access to banking facilities. These chit funds are run by chit fund companies and in the article below we will look at the functioning of chit fund companies, the chit fund business model and the chit fund business registration in India.

What is the Chit fund company registration?

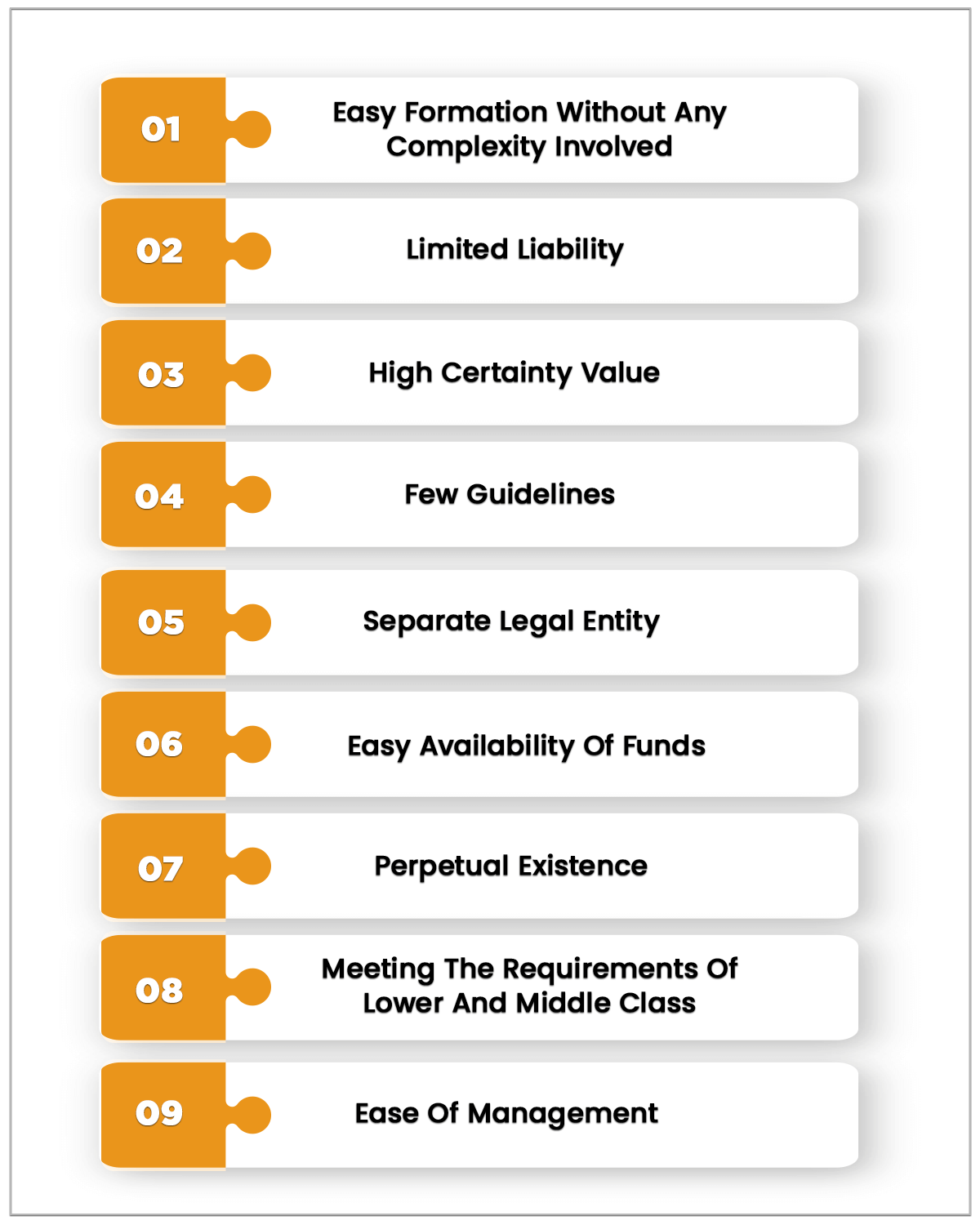

Any entity managing the scheme is typically referred to as a chit fund company. The individual participating in this scheme is referred to as the member. Such a company will commonly have many different schemes. Each of them will have a set of members and a limited duration.

These schemes are operated by the companies with the registration under relevant Chit Fund act. Operations typically involves floating of chit fund schemes, finding the potential members, enrolling the members into a chit, collecting the contributions, conducting the chit auctions, distributing the funds and then most importantly maintaining the books. The companies earn a fixed amount of the member’s contribution for operating the schemes.

To start with, such a company usually advertises a scheme and then starts to enrol members who are interested. All the schemes have a time period, contribution and a set of members. The number of members in the chit will equal to the time period, and each of these member will be required to contribute a fixed amount of money for each period.

Chit Fund Registration

The business in India is regulated under the Chit Fund Act, 1982. According to the Act, a “chit” means a transaction whether called chit, chit fund, chitty, kuri or by any other name by or under which a person enters into an agreement with a specified number of individual that every one of them will subscribe to a certain sum of money (or instead a certain quantity of grain ) by way of periodical installments over a definite time period and that each such subscriber will, in her/his turn, as determined by lot or by auction or by tender or in such other manner as may be specified in chit agreement, be entitled to prize amount. A transaction is not a chit if some alone, but not all, of subscribers get the prize amount without any liability to pay the future subscriptions or all the subscribers get the chit amount by turns with a liability to pay future subscriptions.

Though the chit fund companies are a category of Non-Banking Financial Companies (NBFC), the chit funds are exempt from being registered with the Reserve Bank of India. The chit funds are a category of NBFC which are regulated by the other regulators and hence exempt from the requirement of registration with RBI.

To start this business in India, it is suggested that the promoters of the chit fund company should first start a Private Limited Company with the aim of operating a chit fund business. Once the private limited company is formed, the company can then apply with the appropriate Chit Fund Registrar of the State to obtain the registration. A chit fund business can only be started after obtaining the chit fund business registration from the relevant State Registrar.

Documents

Documents Required for Chit Fund Company

Personal documents of the director

1. PAN Card

2. ID proof (Voter ID card, passport, Aadhar card, driving license)

3. Address proof (Latest bank statement )

4. Passport size photograph

Registered office documents

1. Latest electricity bill Rental agreement (in case the premises is rented) and an NOC from the landlord Sale deed (in case the property is owned)

Pricing

SAVE 35% COST..!!!

(Takes 4-5 days)

We're Here To Help!

Office

H.No 5-100, Shop No 2, Maheshwar Complex Kukatpally main road, Metro Piller NO.A-813, Kukatpally, Hyderabad, Telangana 500072

Hours

M-S: 8am – 8pm

Sunday: Closed

Call Us

(+91 – 9533300120)