Section 8 Company

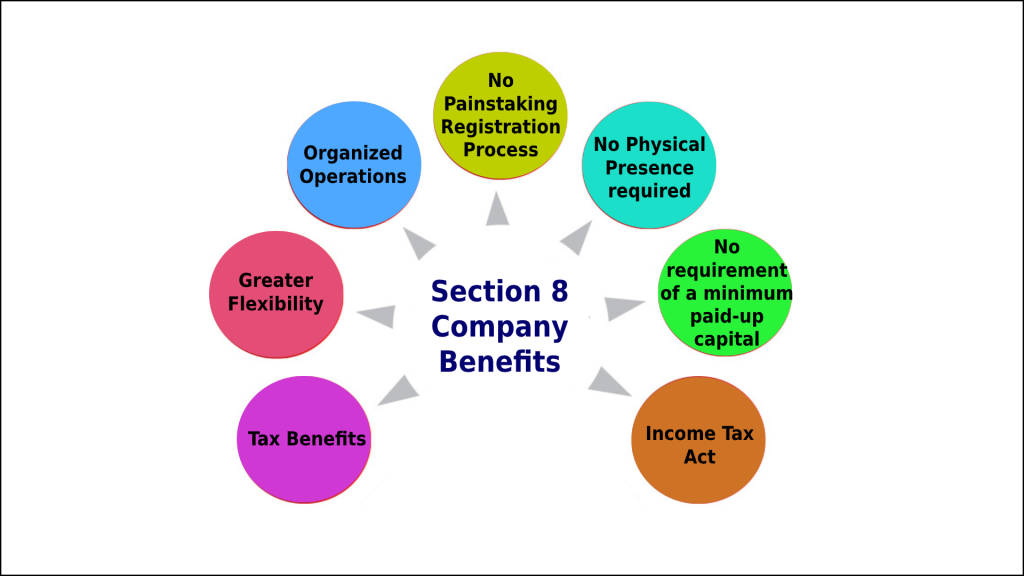

The primary purpose of registering a company as a Section 8 Company is to promote non-profit objectives such as trade, commerce, arts, charity, education, religion, environment protection, social welfare, sports research, etc.

To incorporate a Section 8 Company, a minimum of two directors are required. Also, there is no requirement of minimum paid-up capital in the case of Section 8 Company.

In India, a non-profit organization can be registered under the Registrar of societies or as a Non-profit company under the Section 8 Company of the Company Act,2013.

What is the Section 8 registration?

A non-profit organization can be registered as a trust or society and also as an NPO company under section 8 of the companies act, 2013.Section 8 Company has more benefits in comparison to trust and society. Section 8 company is registered for the charitable purpose or for not for profit business. This type of company has more credibility among donors, government departments, and other stakeholders. NGO registration is offline process except the Section 8 Company registration.

Section 8 company registration is usefull for the following purposes –

· For promoting arts, commerce, science, education, research, social welfare, religion, charity, for environment protection or for any other purpose related to social welfare.

· Provided that they apply their profits in promoting the object of the company.

· It also prohibits the dividend payment to its members.

Its registration is governed by the Ministry of Corporate Affairs whereas the Trust & Society registration is governed by the registrar of state under the State Government.

For Section 8 Company, It is not required to use words ‘LTD’ or ‘PVT LTD’ in their name. With effect from June 5, 2015, under the act, there is no such requirement regarding the minimum capital.

Documents

Documents Required for Section 8 Company

Identity Proof of all the directors - copy of the PAN card (Mandatory).

Address Proof – copy of Aadhar/ Driving License/ Passport/ Telephone Bill/ Electricity Bill.

Passport size photograph of all the directors.

Rent Agreement in case the registered office of the company is on rent.

Utility Bill of registered office.

Form DIR-2 which is consent to act as director.

Director's interest in other entities.

Procedure

Procedure of Incorporation of Section 8 Company registration

Here are the following steps required to incorporate a section 8 company

DSC

First, Obtain the Digital Signature Certificate (DSC) of all the directors and promoters of the company, in case they don’t have the same. For obtaining DSC an application is made to the certifying authority.

DIN

Secondly, to obtain the Directors Identification Number(DIN)for all the directors in the company.

Name Approval

For name approval, an application will be filed in Form INC-1 to the registrar of the company. Maximum six names can be provided for the name approval by the applicant. An approved name is valid for the 60 days. It is required for section 8 company to include the words such as foundation, association, forum, council, chambers etc. in accordance with the company, incorporation rules 2014.

Draft MOA & AOA

After name approval, the next step is to draft MOA & AOA and then it is required to file it to ROC in form INC 12 with other documents for the license under section 8 of the companies act, 2013. The MOA & AOA must be signed by the subscribers of the memorandum.

Application for License

Form INC 12 is filed with the ROC for the issuance of a license to the section 8 company under the Companies Act, 2013.

With the following attachments:

1. INC 13 (Memorandum of Association).

2. Article of association.

3. INC 15 (Declaration by subscribers of the MOA).

4. Statement of Income & Expenditure.

5. List of directors of the company.

6. Subscriber page of MOA & AOA should be handwritten by subscriber and witness.

After approval of the form, the license is issued in Form INC 16.

incorporation

Incorporation Application

Incorporation application is filed in form INC 7 along with the following attachments:

1. Memorandum of Association.

2. Article of Association.

3. Declaration by professional in form INC 8.

4. Affidavit by each subscriber of the memorandum in form INC 9.

5. Address Proof of the subscribers.

6. Identity proof of subscribers.

7. Specimen Signature in Form INC 10.

8. PAN card.

9. NOC if there is any change in the name of promoters after name approval.

10. Board Resolution authorizing to subscribe to MOA.

11. Any other attachments, if any.

incorporation

Form INC 22 is to be filed for the situation of the registered office of the company along with the following attachments:

Incorporation application is filed in form INC 7 along with the following attachments:

1. Rent Agreement/ Lease Deed.

2. Electricity Bill of not older than 2 months.

3. NOC on the letterhead of the promoter for using the premises.

What is included in Our Package :

Registration Fee

Drafting of MOA/AOA

DSC and DIN

Pricing

SAVE 60% COST..!!!

(Takes 4-5 days)

We're Here To Help!

Office

H.No 5-100, Shop No 2, Maheshwar Complex Kukatpally main road, Metro Piller NO.A-813, Kukatpally, Hyderabad, Telangana 500072

Hours

M-S: 8am – 8pm

Sunday: Closed

Call Us

(+91 – 9533300120)