Indian Subsidiary

Incorporation of company as Indian subsidiary of foreign company including 3 DSC, 2 DIN, 1 RUN Name approval, incorporation fee, MOA, AOA, incorporation certificate, PAN, TAN, GST registration, hard-copy share certificates,

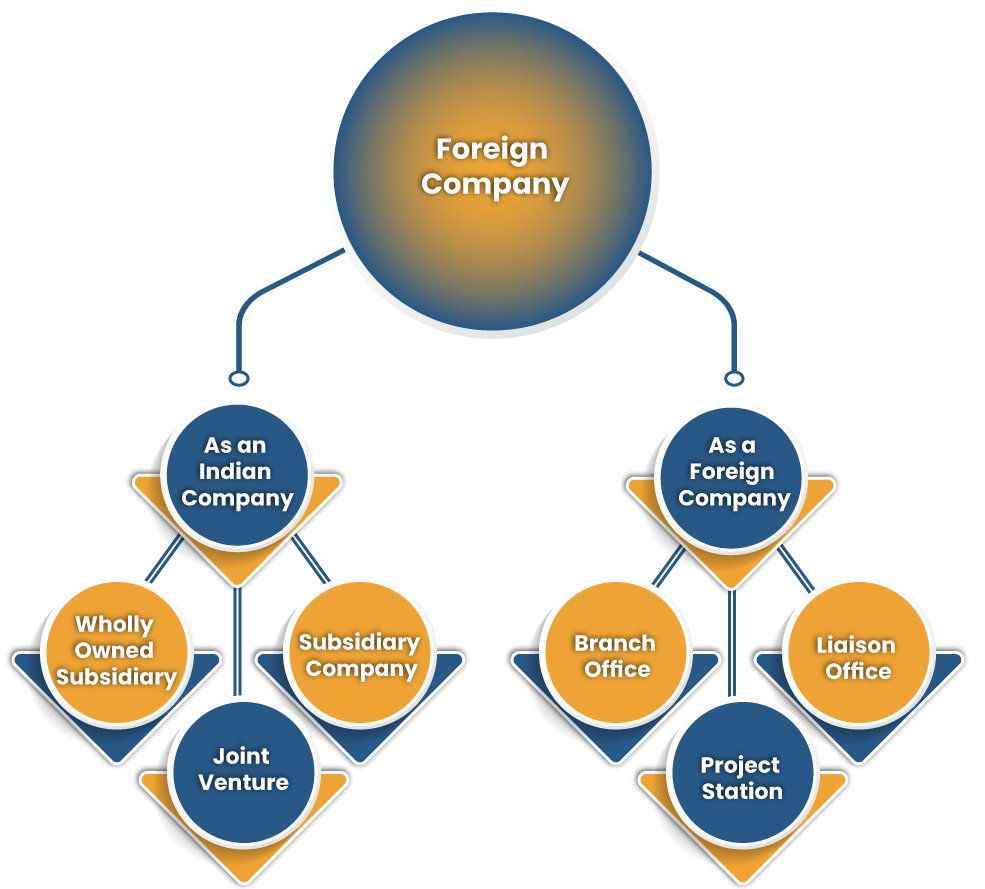

What is the Indian Subsidiary registration?

The Indian subsidiary Company is the company whose interests are held and controlled or held by another company. The preference share capital and the paid-up equity share capital of the Subsidiary company can be used to determine the holding company, subsidiary company relationship between two companies. It can either be owned or owned in part by another company. It should be noted that the company that owns the subsidiary is known as a parent company or a holding company. Although, a holding company does slightly differ from a parent company.

Besides, a company owned 100% by another company is said to be a Wholly Owned Subsidiary of the company who had made 100% investment in it.

Features of Indian Subsidiary Companies :

· No requirement of prior approval for repatriation dividend.

· Debt, Equity, and Internal accruals are the available funding mechanisms.

· Indian Transfer pricing regulation is applicable to the Indian subsidiary Company.

· It is treated as an Indian company for all other applicable laws and the purpose of income tax.

· It is taxed at a lower rate of 30% in comparison to a foreign company whereas a foreign company is taxable at 40%.

· The dividend distribution tax (DDT) is subjected to 16.995%.

Documents

Documents Required for Indian Subsidiary

Utility bills (any)

A copy of a rent agreement with NOC from an owner.

1. Passport of foreign directors

2. Incorporation certificate issued by the foreign government

3. For opening a subsidiary company in India, a resolution from LLC/INC

4. A copy of Voter’s ID/Driving license/Passport & PAN Card of Indian director.

5. 5. Photograph of all directors and shareholder. (Passport-sized)

Advantages

Advantages of India Subsidiary

· Limited Liability:The liability of Directors and members of the private limited company is limited to their shares. This means the company suffers from any loss and faces financial distress because of primary business activity, the personal assets of shareholders/Members/Directors will not be at risk of being seized by banks, creditors, and government.

· Continuity of Existence:Mostly, the life of the business doesn’t affect by the status of shareholders and even after the death of the shareholder the private limited company continues to exist.

· Brand ValueThe brand value of a company will get increased because employees feel secure in joining the private limited company, vendor feels secure in offering credit, investor feels secure in investing, the customer feels trust and confidence in a brand in buying company product or services because of the sound corporate structure. Many startup companies start with zero revenue and rapidly reaches to a multibillion-dollar company in just a few years just because of the high brand value of the company.

· Scope of expansion:The scope of expansion is higher because it is easy to raise capital from a venture capitalist, financial institutions, angel investor, and the advantages of limited liability, the Private limited offer more transparency in the company.

· Foreign Direct Investment in IndiaForeign Direct Investment (FDI) is 100% allowed in several business activities/industries without any prior approval. But FDI is not allowed in Proprietorship or Partnership; LLP requires prior Government approval.

What is included in Our Package :

Registration Fee

Drafting of MOA/AOA

DSC and DIN

Pricing

SAVE 60% COST..!!!

(Takes 20-30 days)

We're Here To Help!

Office

H.No 5-100, Shop No 2, Maheshwar Complex Kukatpally main road, Metro Piller NO.A-813, Kukatpally, Hyderabad, Telangana 500072

Hours

M-S: 8am – 8pm

Sunday: Closed

Call Us

(+91 – 9533300120)