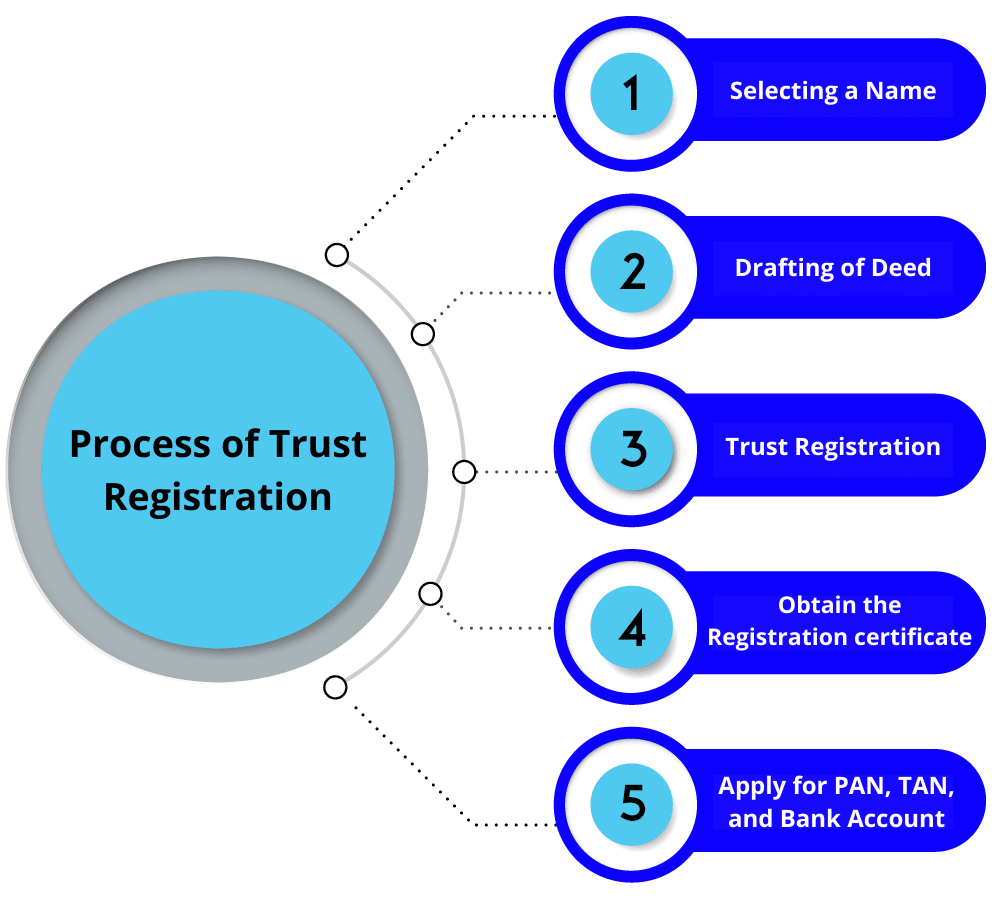

Trust Registration

A private trust may be created either inter vivos or by will. Creation of Trusts are subject to the provisions of Indian Succession Act, 1925.

Prerequisites for Formation of Private Trust

.The existence of the author/settlor of the Trust or someone at whose instance the Trust comes into existence and the settlor to make an unequivocal declaration which is binding on him.

· There must be a transfer of the ownership by the author of the trust in favour of the trustee, where the beneficiary gains.

· A Trust property.

· The objects of the Trust must be precise and clearly specified.

· The beneficiary of the Trust may be a particular person or persons

Pre-Requisition for Formation of Public Trust

· A declaration of Trust which is binding on settlor.

· Setting apart definite property and the settlor relinquishing himself of the ownership thereof.

· A statement of the objects for which the property is hereon held.

· The settlor or the author of the Trust, and the Trustees must be competent to contract.

· After formation of the Trust, the Trust shall not be revoked, barring a few exemptions where the Trust contract contains any clause.

Validation of a Private Trust

The intention on his part to create a Trust

The purpose of the Trust

The beneficiaries and the certainty revolving the beneficiary. An alternative beneficiary must be nominated

The Trust property

Transfer of property to the Trust

Public Trust Formation

Similar to private trusts, public trusts may be created either inter vivos or by will.

Pre-Requisition for Formation of Public Trust

· A declaration of Trust which is binding on settlor.

· Setting apart definite property and the settlor relinquishing himself of the ownership thereof.

· A statement of the objects for which the property is hereon held.

· The settlor or the author of the Trust, and the Trustees must be competent to contract.

· After formation of the Trust, the Trust shall not be revoked, barring a few exemptions where the Trust contract contains any clause.

Book-Entry for Trust Formation

Book entries for Trust formation can be of two types, which we’ll explain in brief:

Entries made by the Donor in his own Books

The basic requisite to make a declaration of trust valid is that the donor should have absolutely parted with that interest which was owned by him at the time of the declaration. If there is no setting apart of ascertained property and no disinvestment on the part of the settlor of the ownership thereof, mere book-entry cannot result in an effective trust.

Entries made on Debtors Books

If a credit entry is made in the books of the debtor in favor of a trustee displaying an interest in the creation of a trust rather than in the books of a donor, such an entry would amount to a specific appropriation for the trust.

Pricing

SAVE 60% COST..!!!

(Takes 5-7 days)

We're Here To Help!

Office

H.No 5-100, Shop No 2, Maheshwar Complex Kukatpally main road, Metro Piller NO.A-813, Kukatpally, Hyderabad, Telangana 500072

Hours

M-S: 8am – 8pm

Sunday: Closed

Call Us

(+91 – 9533300120)